Introduction

The thermoformed containers market is experiencing notable growth as industries across food and beverage, pharmaceuticals, electronics, and consumer goods demand efficient, cost-effective, and sustainable packaging solutions. Thermoforming—a manufacturing process where a plastic sheet is heated and molded into a specific shape—offers flexibility, high production speed, and relatively low tooling costs. These advantages make thermoformed containers an increasingly popular choice globally.

The market is driven by changing consumer behavior, sustainability concerns, advancements in packaging materials, and the need for lightweight, durable packaging formats.

Source – https://www.databridgemarketresearch.com/reports/global-thermoformed-containers-market

Market Overview

Thermoformed containers include a wide range of packaging products such as trays, clamshells, cups, and lids used for storing, transporting, and displaying goods. These containers are generally made from materials like PET (Polyethylene Terephthalate), PVC (Polyvinyl Chloride), PP (Polypropylene), and PLA (Polylactic Acid), catering to both conventional and eco-friendly packaging demands.

The thermoforming process is versatile, allowing for both rigid and semi-rigid containers, and supports high customization based on client specifications, which further drives adoption in multiple sectors.

Market Drivers

1. Rising Demand in the Food and Beverage Sector

The food industry remains the largest consumer of thermoformed containers, primarily for packaging fresh produce, ready-to-eat meals, dairy products, and meat. The need for hygienic, tamper-evident, and shelf-stable packaging continues to stimulate demand.

2. Increased Preference for Lightweight Packaging

Thermoformed containers are significantly lighter than glass or metal alternatives, reducing transportation costs and contributing to sustainability goals. This lightweight characteristic is especially beneficial for e-commerce and export-oriented industries.

3. Cost-Efficiency in Manufacturing

Compared to other plastic molding processes, thermoforming has a lower tooling cost, faster setup time, and is well-suited for both short and high-volume production runs. This makes it ideal for companies seeking economical packaging solutions.

4. Sustainable and Recyclable Materials

Manufacturers are increasingly offering containers made from biodegradable or recyclable plastics like PLA and rPET. As sustainability becomes a key purchasing factor, eco-friendly thermoformed containers are gaining favor among both companies and end consumers.

5. Growth of the Retail and E-Commerce Sector

With the rise of online shopping and home delivery services, there is growing demand for secure, tamper-resistant packaging. Thermoformed containers provide visibility (clear plastic), protection, and ease of handling—key requirements for modern retail packaging.

Market Segmentation

By Material Type:

-

PET

-

PVC

-

PP

-

Polystyrene

-

PLA (biodegradable)

-

Others (HDPE, LDPE)

By Product Type:

-

Blister Packs

-

Clamshells

-

Trays and Lids

-

Bowls and Cups

-

Custom Containers

By End-Use Industry:

-

Food and Beverages

-

Pharmaceuticals

-

Electronics

-

Personal Care and Cosmetics

-

Industrial Goods

-

Household Products

By Forming Type:

-

Vacuum Forming

-

Pressure Forming

-

Mechanical Forming

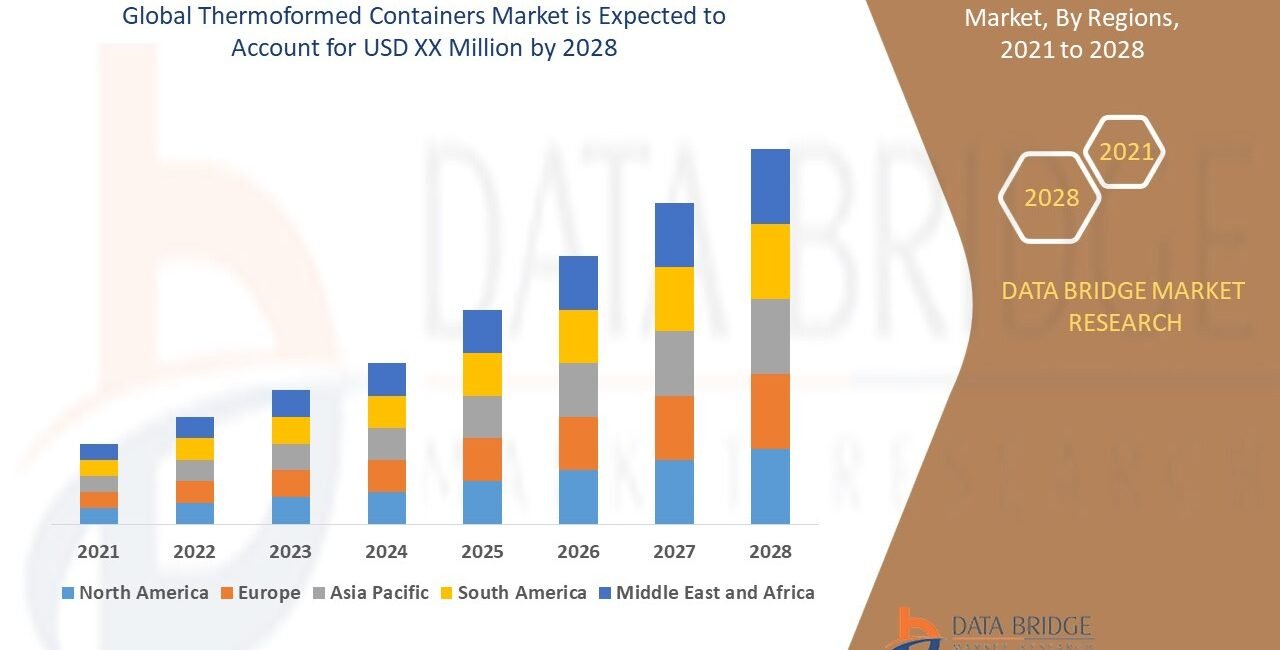

Regional Insights

North America:

A mature market with strong adoption in the food packaging and healthcare sectors. Demand for sustainable materials and single-serve food packaging is especially prominent.

Europe:

Environmental regulations and consumer awareness are driving the shift towards biodegradable and recyclable thermoformed containers. Innovation in sustainable packaging is a key market trait.

Asia-Pacific:

The fastest-growing region, led by rapid industrialization, urbanization, and expansion in the retail and food service sectors in countries like China, India, and Southeast Asian nations.

Latin America and Middle East & Africa:

Emerging markets with increasing adoption of modern retail formats and packaged food products, presenting strong growth opportunities for thermoformed container manufacturers.

Challenges

1. Environmental Concerns Over Plastics

Although recyclable and biodegradable options are increasing, conventional plastic waste remains a concern. Stricter regulations may impact the use of non-recyclable materials in certain regions.

2. Volatility in Raw Material Prices

Price fluctuations in petroleum-based plastic resins affect manufacturing costs and can influence pricing strategies across the supply chain.

3. Competition from Alternative Packaging Formats

Paper-based packaging, molded pulp, and flexible films are gaining ground in sustainability-conscious markets, creating competition for thermoformed solutions.

4. Recycling Infrastructure Limitations

In developing regions, the lack of advanced recycling facilities can limit the effectiveness of sustainable packaging initiatives.

Opportunities and Future Outlook

-

Smart and Functional Packaging: Integration of QR codes, temperature sensors, and anti-counterfeit features into thermoformed packaging for added value.

-

Custom Packaging Solutions: Growing demand from industries for unique branding and product protection solutions.

-

Sustainability Focus: Continued innovation in biodegradable plastics, recycled content, and closed-loop packaging systems.

-

Automation and Digital Printing: Adoption of advanced machinery and on-pack digital technologies to streamline production and enhance shelf appeal.

The global thermoformed containers market is expected to expand steadily in the coming years, driven by the convergence of functional performance, cost-efficiency, and the growing demand for sustainable and consumer-friendly packaging solutions.